Variable Cost Ratio | Variable costs can be calculated as the sum of marginal costs over all units produced. In other words, it shows the relationship between net sales and. Variable costs and expenses divided by net sales. Variable costs go up when a production company increases output and decrease. The variable cost ratio is a cost accounting tool used to express a company's variable production costs as a percentage of its net sales.

Variable costs can be calculated as the sum of marginal costs over all units produced. Meanwhile, a variable cost ratio is the result when you divide the total variable costs with the total sales. The ratio of variable cost to fixed costs shows how much adjustable an organization is to the changing situations. Suppose, for example, you made wooden toys in a workshop. The one variable cost you may have difficulty negotiating is direct labor costs.

In accounting, variable costs are costs that vary with production volume or business activity. For example, if the price of a product is $100 and its variable. Variable costs are the sum of all labor and materials required to produce a your total variable cost is the sum of the variable cost of each individual product you've developed. Costs associated with a business operation can be broadly classed into two categories: The variable cost ratio tells us the percentage of each sale that is spent on incremental cost of production of the unit sold. Variable costing = (direct labour cost + direct raw material cost + variable manufacturing overhead) free ratio analysis course. What does the contribution margin ratio reveal? The net revenue includes the sum of its returns, allowances, and discounts, subtracted from total sales. Fixed costs and variable costs make up the two components of total cost. Variable cost ratio is the proportion of each sales dollar that must be used to cover variable costs. While the total cost of production helps firms understand the overall expenses incurred, the average therefore, avc is the variable cost per unit of output. Many expenses would be the same every month. Variable costs can be calculated as the sum of marginal costs over all units produced.

Variable costing = (direct labour cost + direct raw material cost + variable manufacturing overhead) free ratio analysis course. The one variable cost you may have difficulty negotiating is direct labor costs. $2000 ÷ $10000 = 0.2. The variable cost ratio presents the relationship between variable costs and the amount of sales a company has. Variable costs can be calculated as the sum of marginal costs over all units produced.

Costs associated with a business operation can be broadly classed into two categories: Variable cost ratio is the proportion of each sales dollar that must be used to cover variable costs. Meanwhile, a variable cost ratio is the result when you divide the total variable costs with the total sales. It can also be computed by subtracting the contribution margin (cm) from 1. Variable costs can be calculated as the sum of marginal costs over all units produced. In accounting, variable costs are costs that vary with production volume or business activity. Sales = variable cost + sales percentage of. Variable cost ratio — variable costs expressed as a percentage of sales. An estimate of the variable cost ratio allows a. The variable cost ratio reveals the total amount of variable expenses incurred by a business, stated as a proportion of its net sales. Step by step guide to calculating financial ratios in excel. $2000 ÷ $10000 = 0.2. The variable cost ratio is a cost accounting tool used to express a company's variable production costs as a percentage of its net sales.

Variable costs can be calculated as the sum of marginal costs over all units produced. The variable cost ratio reveals the total amount of variable expenses incurred by a business, stated as a proportion of its net sales. Variable cost ratio is the proportion of each sales dollar that must be used to cover variable costs. While the total cost of production helps firms understand the overall expenses incurred, the average therefore, avc is the variable cost per unit of output. Reducing variable costs by $1 also would lower the breakeven point by 5,000 units.

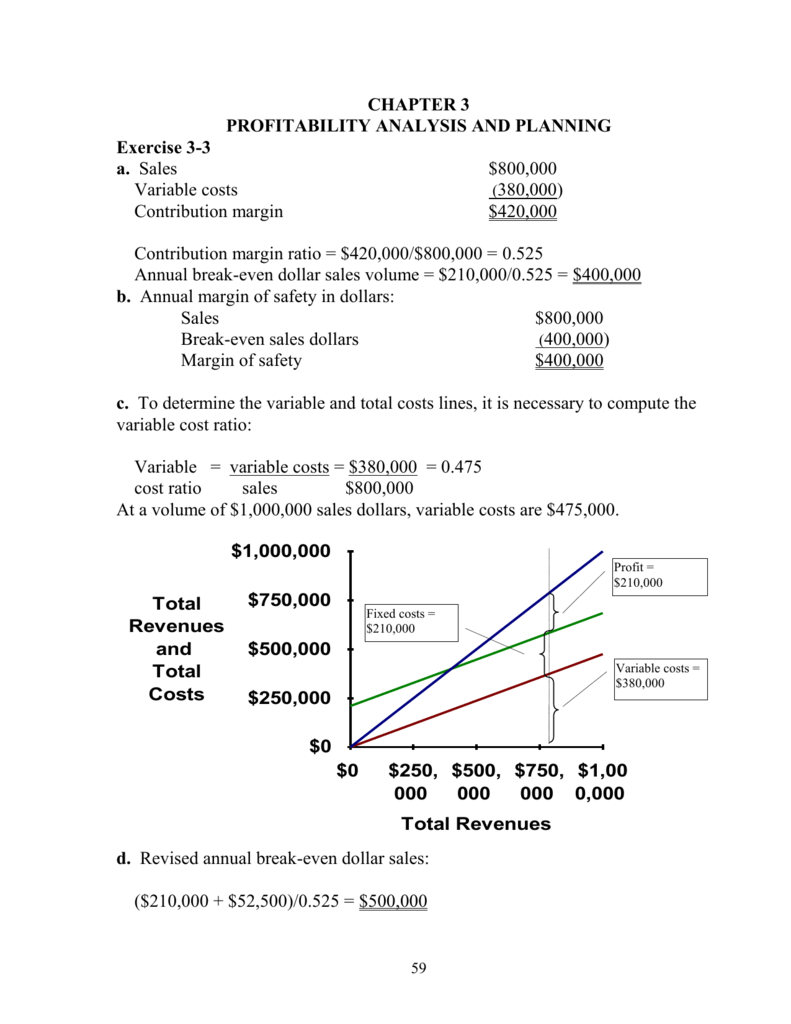

Costs associated with a business operation can be broadly classed into two categories: Variable costs are the sum of all labor and materials required to produce a your total variable cost is the sum of the variable cost of each individual product you've developed. Variable costs can be defined as expenses which keep changing in proportion to the activities of a business. Divide variable costs by net sales and you get the variable cost ratio. The variable cost ratio compares costs, which fluctuate depending on production levels. There are two formulas for calculating variable cost ratio. \(variable \ cost \ ratio = \frac{total \ variable \ cost}{sales}. The variable cost ratio is a financial measurement that calculates dependent costs of production as a percentage of sales. The one variable cost you may have difficulty negotiating is direct labor costs. The net revenue includes the sum of its returns, allowances, and discounts, subtracted from total sales. Variable cost ratio — variable costs expressed as a percentage of sales. The variable cost ratio reveals the total amount of variable expenses incurred by a business, stated as a proportion of its net sales. The variable cost ratio presents the relationship between variable costs and the amount of sales a company has.

Variable Cost Ratio: The variable cost ratio reveals the total amount of variable expenses incurred by a business, stated as a proportion of its net sales.

Source: Variable Cost Ratio